SEC Adopts Final Rules Overhauling Beneficial Ownership Reporting

Client Alerts | October 12, 2023 | Investor Activism | Securities and Corporate Finance

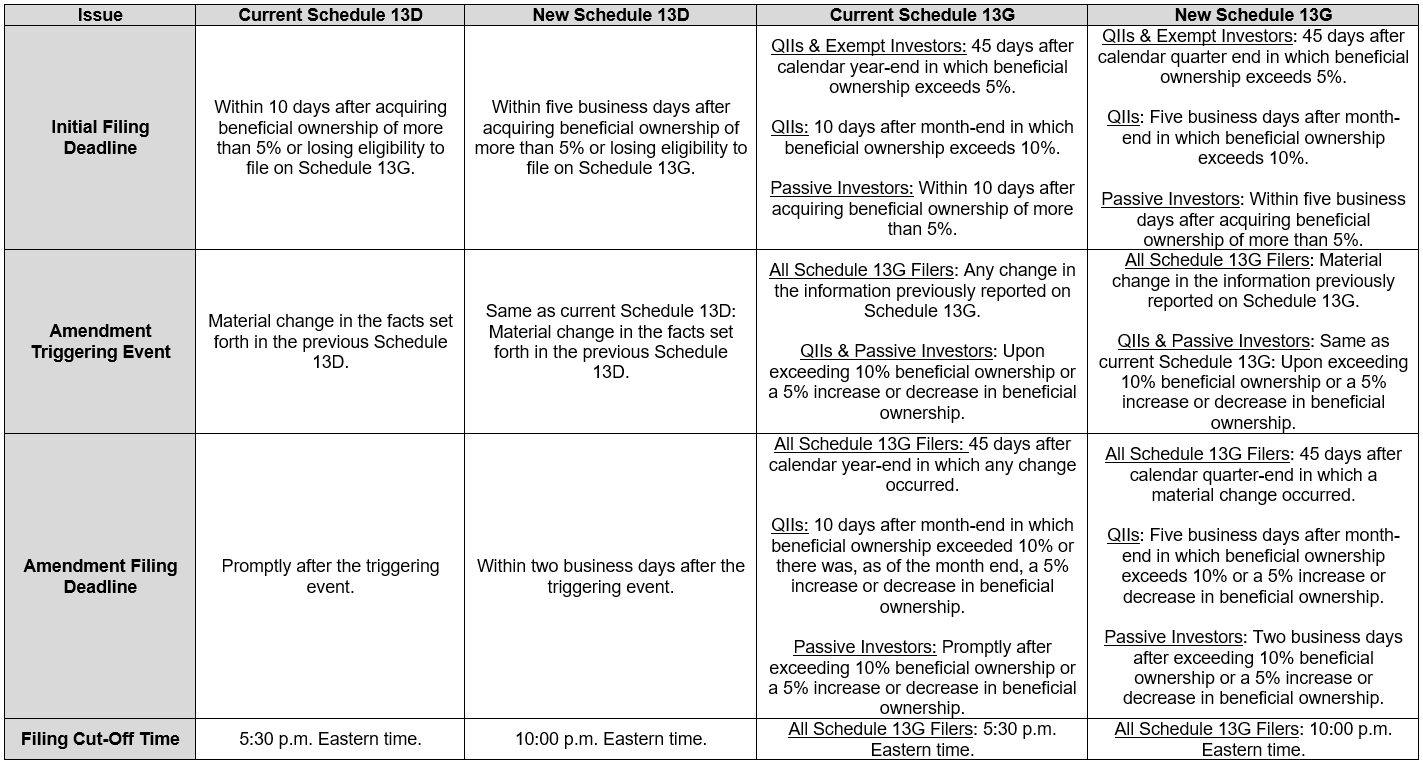

On October 10, 2023, the Securities and Exchange Commission (the “SEC”) announced the adoption of amendments first proposed on February 10, 2022 to Regulation 13D-G and Regulation S-T of the Securities Exchange Act of 1934 (the “Exchange Act”). As described below and as summarized in the chart below, the amendments accelerate the filing deadlines for Schedules 13D and 13G and make certain technical changes to the electronic format of Schedules 13D and 13G and extend the filing time. The amendments and the new reporting obligations associated therewith take effect 90 days after the final rules are published in the Federal Register, and therefore should generally take effect in early 2024. However, the accelerated filing deadlines for filing of Schedule 13G will take effect on September 30, 2024 and certain of the technical format changes will take effect December 18, 2024.

The final rules, differing from the SEC’s original proposal, do not make changes to the treatment of cash-settled derivatives (except for a clarification on 13D reporting obligations discussed below), nor do they change the group formation rules under Sections 13(d) and 13(g) of the Exchange Act (except for a clarification on group reporting obligations discussed below), but the adopting release does provide guidance on the SEC’s views, particularly with respect to group formation, under the current rules.

Accelerated Filing Deadlines

Schedule 13D

Beginning September 30, 2024, an investor who acquires beneficial ownership of over 5% of a voting class of equity securities registered under Section 12 of the Exchange Act (“covered securities”) with the purpose or effect of changing or influencing control of the issuer of such security will need to file their initial Schedule 13D within five business days of crossing the 5% threshold, and will be required to file amendments to their Schedule 13D (which must be filed upon a material change in any item of disclosure) within two business days. Historically, these deadlines were 10 calendar days for the initial filing and “promptly” for the amendments, which practitioners have understood to mean not more than two business days.

The amendments also update the rules relating to conversion from a Schedule 13G (discussed below) to a Schedule 13D. A passive investor who becomes ineligible to file on Schedule 13G, such as because such investor’s purpose has changed from passively holding securities to influencing or changing control, will be required to file its Schedule 13D within five business days after the event causing the ineligibility.

While the amendments do not include the changes originally proposed relating to cash-settled derivatives, the final rule amends Item 6 of Schedule 13D to require disclosure of the investor’s interests in all derivatives, including cash-settled derivatives, that use the issuer’s equity as reference security, regardless of whether the derivative originated with the issuer or is part of the issuer’s capital structure.

Finally, although the changes to the group rules included in the initial proposal were not adopted, the SEC issued guidance on how it views group formation under 13(g) and 13(d), as further discussed below.

Schedule 13G

Schedule 13G is available for investors who acquire over 5% of a class of covered securities but are exempt from filing the longer Schedule 13D by virtue of belonging to any of the following categories: (i) qualified institutional investors under Rule 13d-1(b); (ii) exempt investors under Rule 13d-1(d); or (iii) passive investors under Rule 13d-1(c).

For qualified institutional investors and exempt investors, the amended regulations will require the initial 13G filing to be made within 45 days after the end of the quarter in which the investor first held over 5% of the securities of the issuer, and amendments to be filed within 45 days after the end of the quarter in which the change took place. This changes what has long been an annual filing, required to be made only within 45 days after the end of the year in which the 5% threshold was crossed or the change necessitating the amendment occurred, into a quarterly obligation.

Under the amended regulations, passive investors will have five business days after they exceed 5% to make their initial 13G filing, a shortened timeline matching that for the initial 13D filing, as the initial 13G filing for passive investors is currently 10 calendar days.

The amendments also accelerate the deadline to file 13G amendments for qualified institutional investors and passive investors when the amendment is required because the investor beneficially owns more than 10% of the covered securities, or changed its total beneficial ownership by 5% or more. A 13G amendment will have to be filed within five business days after the end of the month in which a qualified institutional investor’s beneficial ownership first exceeds 10% of a class of securities, and thereafter, within five business days after the end of any month in which such investor’s beneficial ownership changes by more than 5%. Passive investors will be required to file a 13G amendment within only two business days after crossing above the 10% threshold, and thereafter within two business days of any change of more than 5%.

Finally, the amendments change the wording of Rules 13d-2(c) and (d) so that only a “material change” instead of “any change” triggers the requirement to file a 13G amendment. The SEC clarified that “material” has the meaning set forth in Rule 12b-2 of the Securities Exchange Act of 1934, as amended.

Groups

Guidance on Group Formation

The SEC had originally proposed a set of amendments and additions to Rule 13d-5 that would make significant changes to the group formation rules. The SEC, acknowledging that many comments on the proposed rules suggested that the amendments could result in a group being formed even in the absence of evidence of any agreement, arrangement, understanding or concerted action, noted that its intention in proposing the 13d-5 amendments was not to change how it viewed group formation, but to clarify its existing view, and, instead of adopting the bulk of the proposed amendments, issued guidance on how it views what is meant by “act as a group” for purposes of Sections 13(d)(3) and 13(g)(3).

Rule 13d-5(b) provides that when two or more persons act together in their acquisition, sale or voting of an issuer’s securities, they become a group whose beneficial ownership constitutes the beneficial ownership of all members of the group, and who must, if the group collectively exceeds the relevant thresholds, jointly file a Schedule 13D or 13G. Investors must therefore be thoughtful about their engagement with fellow shareholders in a particular issuer’s security because of the possibility of group formation and the resulting joint disclosure requirements.

In the guidance it provided in the adopting release, the SEC emphasized that the determination of group formation is a facts-and-circumstances analysis not dependent on the existence of an express agreement, and is intended to capture informal agreement or concerted action. However, the facts must include evidence of an informal arrangement or coordination – similar actions taken by separate shareholders alone are not conclusive evidence of group formation.

The SEC noted that some commenters on the proposed rules expressed concerns that the amendments would “chill shareholder engagement”, making it difficult for shareholders to communicate with each other or with management of the issuer without forming a group, and provided guidance to clarify when shareholder communication crosses the line and becomes group formation. A group is not formed when, without more, two shareholders of an issuer communicate with each other regarding the issuer, including discussing relating to the long-term performance of the issuer, non-control-related joint engagement, or voting in uncontested elections; nor is a group formed when two or more shareholders engage in discussions with management without taking any action, or make recommendations to an issuer regarding the composition of issuer’s board without discussing individual directors or board expansion, so long as the shareholders do not commit, agree or reach an understanding to vote in a particular way with respect to any such recommendations. Further, the SEC stated that emails, phone calls or meetings between a shareholder and activist investor seeking support for changes would not, alone, be sufficient to satisfy the group formation language, nor would an announcement by a shareholder that it intends to vote in favor of an activist’s nominees.

However, if a communication is made by a shareholder regarding an upcoming (and not yet public) Schedule 13D filing it is planning to make, and the shareholder intended to cause the recipient of the information to purchase securities of the same class as those subject to the 13D reporting obligations of the first shareholder, if the recipient does purchase such securities, a group would have been formed between those shareholders.

Adopted Amendments to 13d-5

The amendments to Rule 13d-5 that the SEC is adopting in the final rule explicitly impute acquisitions made by a group member after the formation of the group to the entire group once the collective beneficial ownership of all group members exceeds 5%. That is, once a group has been formed, acquisitions of securities by any group member are automatically imputed to the entire group. Under the current rules, this presumption was not explicit. The adopted 13d-5 amendments also exempt from the foregoing calculation securities acquired by a group member from another member of the group.

Technical Changes to Filings

As provided in the original proposed amendments, the accelerated filing deadlines for Schedules 13D and 13G discussed above come with extensions to the cut-off time to make such filings from 5:30 p.m. Eastern Time to 10:00 p.m., giving investors a few more hours to timely complete their electronic submissions. Further, Schedules 13D and 13G (excluding exhibits) will be required to be filed using an XML-based language (like Forms 3, 4, 5 and 13F), rather than HTML or ASCII, as is currently required for Schedules 13D and 13G. Compliance with these requirements will not be required until December 18, 2024.

Bottom Line

Investors in public markets should carefully consider the impact of these amendments on their business and investment strategies and prepare for compliance with the accelerated filing deadlines beginning September 30, 2024. Investors should also review carefully the new guidance on group formation – while far from comprehensive, the SEC’s views given on the scenarios described should nonetheless prove useful in considering issues of shareholder communication and engagement for activists and passive investors alike.

* * * *

If you have any questions regarding the final rules adopted by the SEC on beneficial ownership reporting, please reach out to your primary Kleinberg Kaplan contact or a member of the team listed.

Summary of 13D and 13G Changes1

1 Source: https://www.sec.gov/files/rules/final/2023/33-11253.pdf