Tax Issues and Planning to Consider Before Year-End 2020

Client Alerts | November 10, 2020 | Business Advice and Planning | High Net Worth Individual Planning | Hedge Funds | Private Equity Funds | Planning for Fund Managers

November 2020

This annual newsletter briefly highlights certain tax issues and planning that hedge fund managers (and other high-net-worth individuals) should consider (or reconsider) before year-end. Although year-end tax planning is always important, the potential increase in tax rates in 2021 makes it even more important this year-end.

The election may be over, but uncertainty remains over the control of the Senate (which will not be known until early next year) and the general state of the economy, including the continued economic impact of COVID-19. There is also still a great deal of uncertainty in the current tax planning environment, including the possibility of tax rate increases and other elements of the Biden tax plan and the effective date(s) of any changes in tax law (including the possibility of retroactive effective dates).

This newsletter focuses on year-end income tax planning. For estate and gift tax planning, please see “Post-Election Trusts & Estates Planning Considerations” by our Trusts & Estates Department.

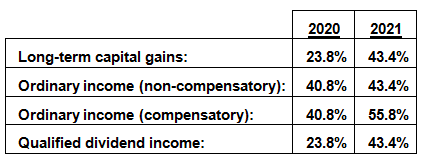

For high-net-worth individuals, the tax rates could be increased under Biden’s tax proposals as follows:

1. Consider

While we would anticipate that tax rates will increase, it is more difficult to predict whether any increases would be effective January 1, 2021, or January 1, 2022, exactly how rates will change and what other tax changes might occur. We may not know until well into 2021. The above rates are just assumptions based on proposals put forth by President-elect Biden and the full details of such proposals are not known.

Some ideas for tax planning due to the potential increases in tax rates are:

-

- Accelerate income into 2020. Realize taxable gains in 2020 that you might not have recognized until 2021 or possibly later. For non-liquid investments, it may take some time to execute a transaction by year-end, so the sales process would need to begin very shortly if feasible. In contrast with losses, there are no “wash sale” or similar rules for gains, meaning you can sell something at a gain and then buy it back soon after.

-

- Pay dividends before January 1, 2021. With tax rates on qualified dividends potentially almost doubling from 23.8% to 43.4%, this could produce significant tax savings for shareholders.

-

- Delay incurring expenses until 2021. Incurring tax deductible expenses in 2021 could be more valuable than incurring such expenses in 2020 when rates are lower. As a caveat, there have been proposals to limit the deductibility of itemized deductions for high-income taxpayers.

-

- Delay paying state and local taxes in 2021. There is a possibility that the deductibility of state and local taxes may be fully reinstated or that the limitation on such deductions may be increased in 2021. Therefore, consider delaying paying state and local income and real estate taxes until 2021.

-

- Pay bonuses in 2020. Employees may prefer to be paid some or all of their bonuses in 2020, instead of early in 2021, so they may be subject to a lower tax rate. Note, in contrast, employers may prefer to pay bonuses in 2021 instead of 2020 (see “Delay incurring expenses until 2021” bullet above). This idea (as with the other ideas) needs to take into account non-tax considerations.

-

- Wash sales. Realize a loss this year and undo the recognition of the loss by entering into a wash sale within 30 days; this provides you with flexibility to take the loss in 2021 if rates increase. The wash sale rules offer a number of ways to potentially avoid their incurrence, to minimize their economic impact, or to potentially convert long-term capital gains to short-term capital gains.

-

- Hedge your bets! Due to the uncertainty regarding tax rates, you may want to hedge your bets regarding whether tax rates will increase and take some actions now which may buy time into next year to see what happens. (i) One example is that you may sell an asset for future payments (i.e., an installment sale) and elect out of the installment sale method by the extended due date of your 2020 tax return (September or October of 2021) if tax rates increase or not elect out if rates do not increase. (The installment method of accounting, however, is not available for publicly traded securities.) (ii) Another example is effecting what could be a constructive sale (e.g., shorting an appreciated stock position) and (A) terminating the constructive sale (e.g., the short sale) by January 30, 2021, and leaving the appreciated position unhedged for 60 days thereafter, in which case there would be deemed not to be a constructive sale in 2020 (you would do this if tax rates do not increase), or (B) not terminating the constructive sale by January 30, 2021, in which case there would be deemed to be a constructive sale in 2020 (you would do this if tax rates increase). (iii) There are also other potential ways to undo a dividend that is distributed in 2020 or to undo a sale, but only within the first few months of 2021.

2. Fund’s 2020 Tax Picture. Your fund’s tax picture should be evaluated throughout the year, but particularly at year-end. How does your fund’s taxable income compare to its book income? Any unrealized gains that you should realize in 2020 to take advantage of 2020 tax rates? Any unrealized gains that are almost long-term that you should consider holding a little bit longer to realize long-term capital gains rather than selling now and realizing short-term capital gains? Any unrealized losses that you should realize? Beware of the wash sale and straddle rules.

3. Non-Tax Impact of Potential Tax Changes on Trading. Will prices for shares in corporations sitting on large amounts of cash increase due to the potential that they will distribute the cash? Will there be more redemptions of stock? What are the consequences of purchasing shares in advance of a large dividend distribution? Will a potential increase in corporate tax rates decrease stock prices generally?

4. Changing Your Incentive Allocation to an Incentive Fee. If carried interest taxation is changed to being taxed at ordinary tax rates generally, it may be preferable to change to an incentive fee. There are many factors to consider in determining whether this may be beneficial or harmful to fund managers and fund investors. Fund documents should generally include this flexibility.

5. Consider Making a Section 475(f) Election. A Section 475(f) election to mark-to-market securities can offer significant tax benefits for a trader in securities. For example, if you are a trader and have significant net unrealized losses, you could defer realizing the losses until 2021 and elect to mark-to-market for 2021, thus converting capital losses to ordinary losses and applying them against income subject to tax at the higher 2021 tax rates. If you have unrealized gains, you could wait until 2021 and realize the gains in 2021 and be subject to tax on the income over 4 years, but you would also be converting capital gains to ordinary income. A Section 475(f) election may offer other tax benefits as well. Also, if your fund already has a Section 475(f) election in place, you should consider whether it should be revoked, depending on your facts and circumstances.

6. Post-Year-End Tax Planning. There are many other tax planning ideas to potentially reduce your effective tax rate going forward.

-

- State tax residency. Due to the effectiveness of remote working, some have considered changing their residency, including to low-tax jurisdictions. But beware of traps like the “convenience of the employer” rule and the possibility that a move results in double state taxation.

-

- Puerto Rico and the USVI. Puerto Rico and the USVI offer U.S. citizens the ability to potentially significantly reduce their federal tax rate without giving up their citizenship.

-

- State and local tax-free trusts. Trusts can offer significant tax planning opportunities. One potential benefit is avoiding the imposition of state and local taxes on trust income. With state and local tax rates potentially being increased, these trusts may offer increased tax benefits.

-

- Private Placement Life Insurance/Insurance Dedicated Funds. PPLI and IDFs may offer the opportunity to reduce income and estate taxes and a way to increase assets under management.

-

- Passive Foreign Investment Companies. PFICs may offer a way to reduce or defer federal taxes (at a low interest rate) and may offer a way to reduce or defer state and local taxes as well.

-

- Opportunity Zones. Investing in opportunity zones may offer a way to defer taxes or eliminate taxes (on subsequent appreciation). The opportunity zone rules may be subject to change under the new Administration, and deferral may not be a good play if rates are increasing over time.

-

- Excess Business Loss (“EBL”) Rules. The EBL limitation rules, which were enacted as part of the TCJA but were retroactively eliminated for tax years 2018 through 2020 as part of the CARES Act, will come back into play for 2021. The CARES Act made several other changes to the EBL rules, including that wage income will not be considered to be business income. The impact of the EBL rules to managers should be considered, particularly if the funds managed are considered to be investors, and not traders, for tax purposes.