SEC Amends Rule 14a-8 To Raise the Bar for Shareholder Proposals

Client Alerts | September 29, 2020 | Hedge Funds | Investment Management | Investor Activism

On September 23, 2020, the Securities and Exchange Commission (the “SEC”) announced that it had voted to adopt amendments to Rule 14a-8 and the process for shareholder proposals (the “Amendments”).1 The Amendments purport to “modernize” the shareholder proposal process, but in practice will limit the range of shareholders who are eligible for their proposals to be included in a company’s proxy materials and will likely limit the scope of issues that are considered at annual meetings.

14a-8 Proposals Now

Rule 14a-8 specifies when a company must include a shareholder’s proposal in its proxy materials, including the form of the proposal and who may submit such proposals. Currently, submitting shareholders must hold shares equaling the lesser of $2,000 in market value or one percent of outstanding securities for at least a year. In addition, the proposing shareholder must continue to hold these securities through the date of the annual meeting. Rule 14a-8 works from the presumption that all shareholder proposals must be included in the company’s proxy materials unless there is a reason for exclusion – often an improper purpose or a technical disqualification.

14a-8 proposals offer an attractive method for smaller shareholders to have a voice in the companies in which they are invested. First, they offer a path for shareholders to have their proposals considered by the rest of the company’s shareholders without the administrative burden and expense of drafting and issuing their own proxy statement. Second, 14a-8 proposals have much less stringent disclosure requirements than a full Rule 14A proxy statement. Finally, the relatively small ownership requirements permit a wide opportunity for shareholder involvement.

While 14a-8 proposals are precatory and non-binding on public companies, in recent years 14a-8 proposals have enjoyed the status of becoming a pipeline for shareholders to shine a spotlight on environmental, social and governance (ESG) issues. Despite being non-binding, starting these conversations have acted as a catalyst for ESG issues in modern corporate America.

These proposals have nonetheless been the subject of criticism from pro-management sources and internal counsel, who have complained (with some justification) of burdens in time and resources that are disproportionate to the support some such proposals receive. Proponents have pointed to Rule 14a-8 proposals that have found limited support in the first year they have been presented to shareholders, but which have been adopted against significant odds in subsequent years.

The Amendments

The Amendments adopted by the SEC, among other changes, sharply multiply the ownership requirements for submitting a 14a-8 shareholder proposal, limit shareholders’ ability to meet these thresholds and make it more difficult for shareholders to resubmit their proposals in subsequent years.

The Amendments introduce a new tiered eligibility system under which the amount of stock the shareholder must own in order to submit a proposal is decreased the longer the shareholder has held the stock. Specifically, to be eligible to submit a proposal a shareholder must have held at least $25,000 worth of a public company’s outstanding stock for at least one year, at least $15,000 worth for two years and $2,000 for three or more years. This is a drastic increase from the current system, and aims to ensure that only larger shareholders will have an immediate voice at the company.

Further, the Amendments have eliminated the possibility of multiple smaller shareholders banding together to aggregate their holdings to meet the ownership requirements, which seems strangely counter to the principles behind “group” rules. Under the Amendments, a shareholder must meet the ownership eligibility requirements independently in order to submit a 14a-8 proposal. The Amendments also require the shareholder to provide dates and times that they are available to speak with the company concerning their proposal no less than 10 and no more than 30 days after the submission of their proposal.

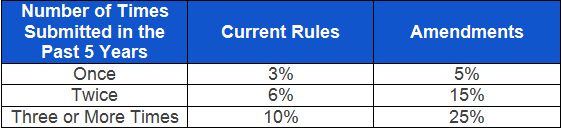

In addition, the Amendments have increased the level of support a proposal must have for a shareholder to be able to resubmit such proposal to shareholders. In order to have their proposal included again on a company’s proxy materials within five years since the original proposal, the proposal must have received certain levels of support based on the number of times the proposal was considered by shareholders as summarized under the current rules and adopted Amendments in the following chart:

In the press release announcing the Amendments, the SEC states that it conducted a review of 14a-8 proposals submitted between 2011 and 2018 which ultimately received majority support on a second or more submission. That review found:

“Of those proposals that ultimately went on to receive majority support, 98 percent of the proposals started with support of over 5 percent of the votes cast in their first submission. Of the proposals that obtained majority support on their third or subsequent submissions, approximately 95 percent received support of over 15 percent on their second submission, and 100 percent received support of over 25 percent on their third or subsequent submission.”2

Effect on Shareholders

The Amendments will likely have a cooling effect on 14a-8 proposals and reduce the number of submissions in the coming years. It will be much more difficult for small shareholders to meet the eligibility requirements, especially if the shareholder acquired their position recently. While the SEC has stated that this overall reduction to 14a-8 proposals will be a benefit to public companies, saving them the administrative and legal burden and costs of considering and responding to each submission, it should also be noted that the players now able to take the 14a-8 microphone will likely be a smaller, more homogeneous group, and the topics they chose to voice will likely becomes more limited as well. On balance, these changes reflect a change to a more pro-issuer, less investor-friendly focus under the stewardship of Chairman Jay Clayton.

Next Steps

The Amendments will take effect 60 days after publication in the Federal Register and will apply will apply to any proposal submitted for an annual or special meeting to be held on or after January 1, 2022. However, the Amendments also provide for a transition period with respect to the ownership thresholds and will allow shareholders meeting certain conditions to rely on the $2,000/one-year ownership threshold for proposals submitted for an annual or special meeting to be held prior to January 1, 2023.

1 SEC Adopts Amendments to Modernize Shareholder Proposal Rule, Securities and Exchange Commission, September 23, 2020, Release 2020-220 (https://www.sec.gov/news/press-release/2020-220).