Tax Issues and Planning to Consider Before Year-End 2021

Client Alerts | December 7, 2021 | High Net Worth Individual Planning | Hedge Funds | Private Equity Funds

This annual client alert briefly highlights certain tax issues and planning that hedge fund managers and high-net-worth individuals should consider (or reconsider) before the end of 2021. Although year-end tax planning is always important, the potential increase in tax rates in 2022 and other potential tax changes make it even more important this year-end.

The scope and specific details of legislative tax proposals have significantly changed over the last few months and may change further prior to potential enactment. This newsletter focuses on year-end tax planning generally, but also considers planning that is responsive to the most recent tax proposals. The tax proposals still may not be enacted and may be subject to change, so there is still some significant uncertainty regarding year-end planning.

We will send another tax client alert in early January with some post year-end planning to consider in early 2022.

Applicable Proposed Changes

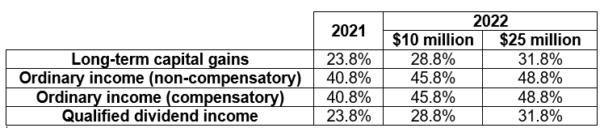

For high-income individuals (those with modified adjusted gross income (“MAGI”) of at least $10 million or $25 million), the U.S. federal income tax rates would be increased under the tax proposals as follows:

The increased rates would apply to non-grantor trusts having income of at least $200,000 and $500,000, respectively.

The above rates include the 3.8% tax on self-employment or net investment income.

These rates, when combined with state and local tax rates, can result in extremely high tax rates. For example, an individual who is a resident of New York City and has MAGI more than $25 million a year would suffer a combined effective marginal tax rate on ordinary income of about 63.5%, assuming there is no deductibility of state and local taxes (which is discussed below).

There are many other proposed tax changes, two of which would significantly impact hedge funds and their managers.

One proposal would subject any income that is not subject to the self-employment tax (the “SE tax”) to the net investment income tax (the “NII tax”). As discussed below, the “LP technique” would no longer provide a path to avoiding both the SE tax and the NII tax on management fee income.

Another key potential change, that would significantly impact the use of leveraged blockers, would be to treat interest paid to a shareholder who owns 10% or more by vote or value as not qualifying for the portfolio interest exemption, and thus subject to 30% withholding tax (or a lower rate if reduced by an applicable treaty). This is also discussed below. This proposal would apply to obligations issued after the date of enactment (i.e., existing obligations would be grandfathered).

1. Some ideas for year-end tax planning due to the potential increases in tax rates for individuals with MAGI in excess of $10 million are:

- Accelerate income into 2021. Realize taxable gains in 2021 that you might not have recognized until 2022 or possibly later. For non-liquid investments, it may take some time to execute a transaction by year-end, so the sales process would need to begin very shortly if feasible. In contrast with losses, there are no “wash sale” rules for gains, meaning you can sell something at a gain and then buy it back soon after without having the gain suspended. In comparison to prior tax rate changes, the proposed tax rate changes only apply to individuals with very high income, so any tax planning at the fund level might need to consider that not all investors would benefit from the acceleration of income.

- Pay dividends before January 1, 2022. With tax rates on qualified dividends potentially increasing by 8%, this could produce significant tax savings for shareholders.

- Delay incurring expenses until 2022. Incurring tax deductible expenses in 2022 could be more valuable than incurring such expenses in 2021 when rates are lower.

- Delay paying state and local taxes in 2022? Whether and how much the deductibility of state and local taxes increases is not clear. There is a possibility that the amount deductible increases from $10,000 to $80,000 or the limitation is possibly suspended for a year or two (the latter seems unlikely). It may be possible to obtain a deduction for certain state taxes in certain states. See below regarding pass-through entity taxes.

- Pay bonuses in 2021. Employees may prefer to be paid some or all of their bonuses in 2021, instead of early in 2022, so they may be subject to a lower tax rate. Note, in contrast, employers may prefer to pay bonuses in 2022 instead of 2021 (see “Delay incurring expenses until 2022” bullet above). This idea (as with the other ideas) needs to take into account non-tax considerations.

- Wash sales. Realize a loss this year and potentially undo the recognition of the loss by entering into a wash sale within 30 days; this provides you with flexibility to take the loss in 2022 if rates increase. The wash sale rules may offer ways to potentially avoid their incurrence, to minimize their economic impact, or to potentially convert long-term capital losses to short-term capital losses.

- Hedge your bets! Due to the uncertainty regarding tax rates, you may want to take some actions now that may provide optionality and which may buy time into next year to see what happens. One example is that you may sell an asset for future payments (i.e., an installment sale) and elect out of the installment sale method by the extended due date of your 2021 tax return (September or October of 2022) if tax rates increase or not elect out of if rates do not increase. (The installment method of accounting, however, is not available for publicly traded securities.) Another example is effecting what could be a constructive sale (e.g., shorting an appreciated stock position) and (A) terminating the constructive sale (e.g., the short sale) by January 30, 2022, and leaving the appreciated position unhedged for 60 days thereafter, in which case there would be deemed not to be a constructive sale in 2021 (you would do this if tax rates do not increase); or (B) not terminating the constructive sale by January 30, 2022, or not leaving unhedged for 60 days thereafter, in which case there would be deemed to be a constructive sale in 2021 (you would do this if tax rates increase). There are also other potential ways to undo a dividend that is distributed in 2021 or to undo a sale, but only within the first few months of 2022.

- Cryptocurrencies. Currently, the wash sale rules and constructive sale rules do not apply to cryptocurrencies, so this leaves potential tax planning if you are sitting on gains or losses on cryptocurrencies. You could sell the cryptocurrencies at a loss or a gain and immediately buy them back. (Note, the tax proposals would subject cryptocurrencies to the wash sale rules and constructive sale rules effective January 1, 2022.

2. Carried Interest Tax Planning — Final Regulations go Into Effect on January 1, 2022! The proposed tax changes do not make any changes to the taxation of carried interests. However, the final carried interest regulations issued in January 2021 become effective on January 1, 2022. Under the final regulations, only growth on realized carry is not subject to the carried interest rule (which recharacterizes 1 to 3 year gains as short-term capital gains). Therefore, it may be prudent to realize gains this year on current carry or on unrealized carried interests from prior years, including carry that had been carved out as limited partnership interests but which includes unrealized appreciation. Another issue to consider is if it would be preferable to change an incentive allocation to an incentive fee. There are many factors to consider in determining whether this may be beneficial or harmful to fund managers and fund investors. However, this may be less beneficial than before (in certain circumstances) due to the inability to not be subject to the SE tax and the NII tax (discussed below).

3. Consider SE tax versus NII tax. The proposals would effectively do away with the “LP technique” used by many investment managers to avoid both the SE tax and the NII tax. Rather than amend Section 1402(a)(13) to cause a limited partner’s share of the partnership’s income to be subject to SE tax, the proposed change expands the taxation of the NII tax to include certain business activities that were not previously subject to the NII tax. Under the new rules, a person may still be able to avoid the SE tax with respect to income earned as a limited partner, but that income would be subject to the NII tax. Because the SE tax only applies to 92.35% of income and is 50% deductible, the SE tax, although imposed at the same 3.8% rate as the NII tax (assuming income above the threshold so that the higher SE tax rate applies at 3.8%) is actually effectively about 2.8%; thus, the effective SE tax rate is about 1% lower than the NII tax. Investment managers would no longer need to be limited partnerships and, ironically, it might be preferable for investment managers (at least new ones) to be limited liability companies.

4. Fund U.S. Blocker Corporations with Debt to Qualify as Portfolio Interest. Many U.S. blocker corporations are funded with debt and equity. Interest on the debt may reduce the taxable income of the blocker corporation, subject to certain limitations. Further, the debt and equity may be structured so that interest on the debt that is paid to non-U.S. persons is classified as portfolio interest. Portfolio interest is not subject to 30% U.S. withholding tax. Currently, interest that is paid to a shareholder that owns 10% or more by value (but not by vote) qualifies as portfolio interest. As proposed, effective with respect to obligations issued on or after the date of enactment, portfolio interest would not include interest paid to a 10% or more owner determined by vote or value. If you are planning to fund a blocker with debt from a 10% or more owner by value but not by vote, such debt should be funded as soon as possible to take advantage of grandfathering.

5. Fund’s 2021 Tax Picture. Your fund’s tax picture should be evaluated throughout the year, but particularly at year-end. How does your fund’s taxable income compare to its book income? Any unrealized gains that you should realize in 2021 to take advantage of 2021 tax rates? Any unrealized gains that are almost long-term that you should consider holding a little bit longer to realize long-term capital gains rather than selling now and realizing short-term capital gains? Any unrealized losses that you should realize? Beware of the wash sale and straddle rules.

6. Consider Making a Section 475(f) Election. A Section 475(f) election to mark-to-market securities can offer significant tax benefits for a trader in securities. For example, if you are a trader and have significant net unrealized losses, you could defer realizing the losses until 2022 and elect to mark-to-market for 2022, thus converting capital losses to ordinary losses and applying them against income subject to tax at the higher 2022 tax rates. If you have unrealized gains, you could wait until 2022 and mark-to-market the gains in 2022 and be subject to tax on the income evenly over 4 years (for example, if you anticipate rates going down or leveling of income over a longer period of time to stay under the $10 million/$25 million thresholds), but you would also be converting capital gains to ordinary income. Alternatively, if your fund already has a Section 475(f) election in place, you should consider whether it should be revoked, depending on your facts and circumstances.

***********

If you have any questions regarding this client alert, please contact your primary Kleinberg Kaplan attorney or a member of our Tax Department listed to the right.