SEC Proposes New “Finder” Exemption Registration

Client Alerts | October 16, 2020 | Securities and Corporate Finance

In an effort to assist small businesses raise capital, on October 7, 2020, the Securities and Exchange Commission (the “SEC”) voted to propose a new limited, conditional exemption (the “Proposed Exemption”) from the broker-dealer registration requirements of Section 15(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) for natural persons who assist private issuers with raising capital from accredited investors in private placements of securities (each such person, a “Finder”).

Through the Proposed Exemption, the SEC is seeking to provide regulatory clarity to investors, issuers and the finders who assist them, in particular, small businesses that are located in places that lack established, robust capital raising networks.

Background

Generally speaking, under the current regulatory framework, “brokers” that raise capital for companies must be registered as a broker-dealer. Under the Exchange Act, a “broker” is defined as “any person engaged in the business of effecting transactions in securities for the account of others.” An issuer that uses an unregistered broker for its capital raise could face civil and criminal penalties, become ineligible to rely on Regulation D and have to return the proceeds of the capital raise to investors (investors have federal, and may also have state, rescission rights), each of which could have an adverse effect on the issuer’s ability to raise capital in the future.

Since 1991, the SEC has accepted the distinction between a “broker” and a “finder” when it issued a no-action letter involving the singer/songwriter Paul Anka. This no-action letter established an extremely limited allowance for a company to provide transaction-based compensation to a “finder” that was not registered as a broker-dealer. Given the rather unique set of facts and circumstances described in the no-action letter, companies and intermediaries gained little practical benefit from the SEC’s conclusions. Ever since the Paul Anka no-action letter, the SEC has further narrowed the availability of this exemption through additional no-action letters.

Given the potentially disastrous results from issuers utilizing unregistered broker-dealers, there has been a need for greater clarity as to what the SEC considers acceptable “finder” activity and what constitutes “broker” activity. If adopted, the Proposed Exemption would not only provide such greater clarity, it would dramatically expand the scope of permissible “finder” activity to be conducted by natural persons for startups and other private companies.

Tier I Finders and Tier II Finders

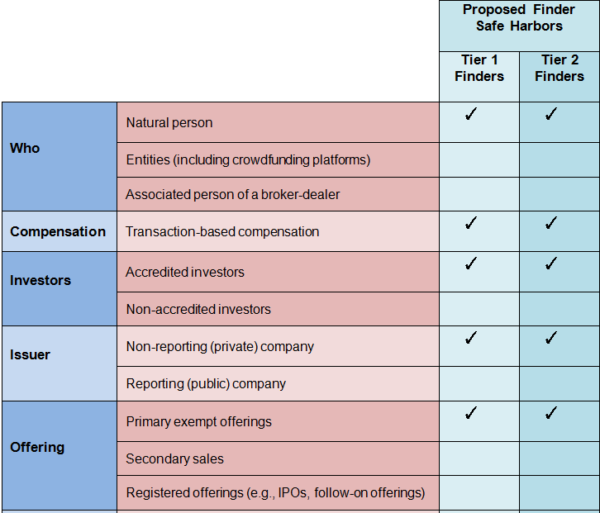

The Proposed Exemption creates two tiers of Finders exempt from registration under Section 15(a) of the Exchange Act.

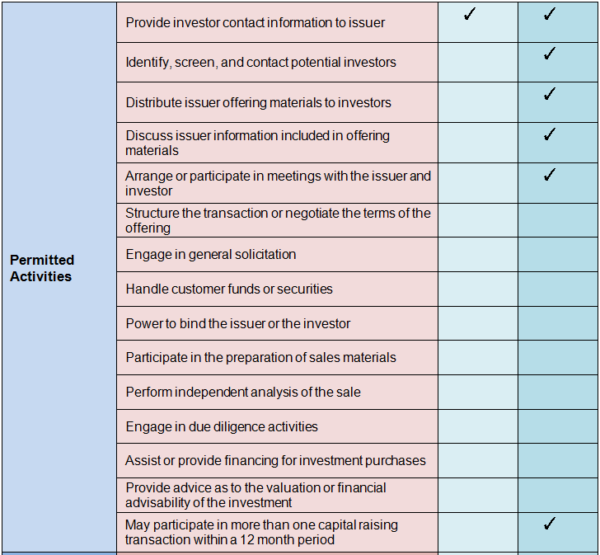

- Tier I Finders – A Tier I Finder would be limited to providing contact information of potential investors in connection with only a single capital raising transaction by a single issuer in a 12-month period. A Tier I Finder could not have any contact with a potential investor about the issuer.

- Tier II Finders – A Tier II Finder may solicit investors on behalf of an issuer, but the solicitation-related activities would be limited to: (i) identifying, screening, and contacting potential investors; (ii) distributing issuer offering materials to investors; (iii) discussing issuer information included in any offering materials, provided that the Tier II Finder does not provide advice as to the valuation or advisability of the investment; and (iv) arranging or participating in meetings with the issuer and investor.

For more information on the distinctions between Tier I Finders and Tier II, please see the below chart.

Conditions to Qualification

For a Finder to be exempt from registration under the Proposed Exemption:

- the issuer must be a private company not subject to Section 13 or Section 15(d) reporting requirements under the Exchange Act;

- the offering for which the Finder is assisting the issuer is a private placement made in reliance on an applicable exemption from registration under the Securities Act of 1933, as amended (the “Securities Act”);

- the Finder does not engage in general solicitation;

- the potential investor is, or the Finder has a reasonable belief that the potential investor is, an “accredited investor” (as defined in Rule 501 of Regulation D of the Securities Act);

- the Finder provides services pursuant to a written agreement with the issuer that includes a description of the services provided and associated compensation;

- the Finder is not an associated person of a broker-dealer;

- the Finder is not subject to statutory disqualification at the time of his or her participation (as defined in Section 3(a)(39) of the Exchange Act); and

- the Finder is a natural person.

Restrictions on Certain Actions

No Tier I Finder or Tier II Finder may: (i) be involved in structuring the transaction or negotiating the terms of the offering; (ii) handle customer funds or securities or bind the issuer or investor; (iii) participate in the preparation of any sales materials; (iv) perform any independent analysis of the sale; (v) engage in any “due diligence” activities; (vi) assist or provide financing for such purchases; or (vii) provide advice as to the valuation or financial advisability of the investment.

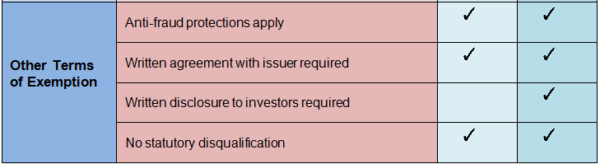

Disclosure Requirement and Acknowledgement for Tier II Finders

Because Tier II Finders are able to participate in a wider array of exempted activities and have the potential to engage in more offerings with issuers and investors, the SEC proposed additional, heightened requirements for Tier II Finders, including a requirement that appropriate disclosures of the Tier II Finder’s role and compensation be made prior to or at the time of the solicitation as well as a dated written acknowledgment of receipt of the required disclosures.

Next Steps

The Proposed Exemption is subject to a 30-day comment period following publication in the Federal Register. Given the dissents from Allison H. Lee and Caroline A. Crenshaw and additional commentary from Commissioner Elad L. Roisman, the Proposed Exemption will likely continue to receive further comments from market participants.

New York State Attorney General Proposal

The New York State Attorney General (“NYAG”) has also proposed changes to New York law to define “finder”. However, the NYAG proposal differs from the Proposed Exemption in a number of ways.

First, the NYAG proposal allows for entities, such as firms, associations or corporations (in additional to natural persons) to be finders if such entity or natural person, as part of a regular business, engages in the business of effecting transactions in securities for the account of others within or from New York State, to the limited extent that such natural person, firm, association or corporation receives compensation for introducing a prospective investor or investors to any broker, dealer or salesperson.

Second, all finders shall be subject to all of the filing and exam requirements of brokers, broker-dealers and salespersons under New York law.